Companies often encounter exceptional talents who work as independent contractors from the contractor community and realize that it would be more advantageous to utilize their skills in a full-time capacity.

On the other hand, you might need more flexible work arrangements to save Labor costs for your company. Hiring independent contractors gives the company multiple benefits, including without the need to report to the department of Labor, issuing employment contracts according to the local Labor laws and local benefits, paying severance pay when the project ends, and overtime pay for intensive tasks.

Suppose contractors are constantly producing high-quality work that benefits the services of a company. Why should the employer demand that they be required to work as full-timers instead of just paying them wages according to their work day?

This article will explore why and when you should transition your contractors or non-formal employees to full-time employment.

When should you convert a contractor to a full-time employee?

When the laws demand for it

As a high-growth company, hiring independent contractors for an urgent yet time-consuming project is a common strategy to cope with the ever-changing business needs according to the market demand. However, do you know that:

Here is one recent example of the sporting company Nike, which employs over 79,000 staff globally. During peak seasons, such as new product launching or new outlets opening, the company usually requires huge human resources to support graphic design, photography, temporary event planning, business consultancy services, etc.

According to data obtained by the media 1, Nike may have misclassified thousands of temporary project workers, which could be subject to paying employment taxes and penalties over $530 million.

The world-class company's methods of handling independent contractors have exposed it to the threat of escaping tax obligations and non-compliance to the local Labor laws in providing the employee benefits such as the social security system, filing employee income taxes, and public holidays.

An employee has the right to log in and complain to the trade union if they are misclassified as an independent contractor exploiting employment rights and benefits.

When the contractor performs a core business service

While hiring contractors, employers need to note that contractors are not economically dependent on the employer and are conducting business for themselves or their company, not for the employer.

As such, the issue arises when the work, including the work production, is an integral part of the employer's business purposes and the degree of control the employer has exerted over the contractor.

FLSA provision dictated that the act should cover all persons performing work; a person who follows the typical path or company's direction depends on the company they work for and is considered an employee 2.

Therefore, instead of "technical concepts," the FLSA emphasizes the "economic reality" in determining the employer-employee relationship.

Click to view the 10 key differences between a contractor and an employee that AYP has prepared for you.

Local compliance considerations

Contractors are often working on multiple projects; hence they are not bound by employment contracts that demand a minimum hour contribution such as 45 hours per week to the company according to the Labor law or overtime work restrictions and overtime hours compensation rate according to the local laws.

However, if your contractor starts to commit to their work and perform core services that benefit your business, converting them is the safest and most compliant way.

Nevertheless, complying with different countries' specific Labor laws can be challenging with a local legal advisor. Considerations such as the number of days worked per week, determining the ordinary rate of pay, and understanding how Labor laws apply to service businesses are essential.

Additionally, when converting a contractor to an employee, determining an appropriate hourly rate of pay, adhering to working hours regulations, addressing matters such as compensation for a day's wages during public holidays and overtime, and ensuring the provision of rest days are crucial components of compliance.

Understandably, companies often demand more control yet flexible project timespan workers, especially during high growth expansion periods. However, it is important to engage an EOR (employer of record) who is able to advise you on the compliance way to expand according to the country's Labor laws whenever you wish to expand.

When you demand for more commitments

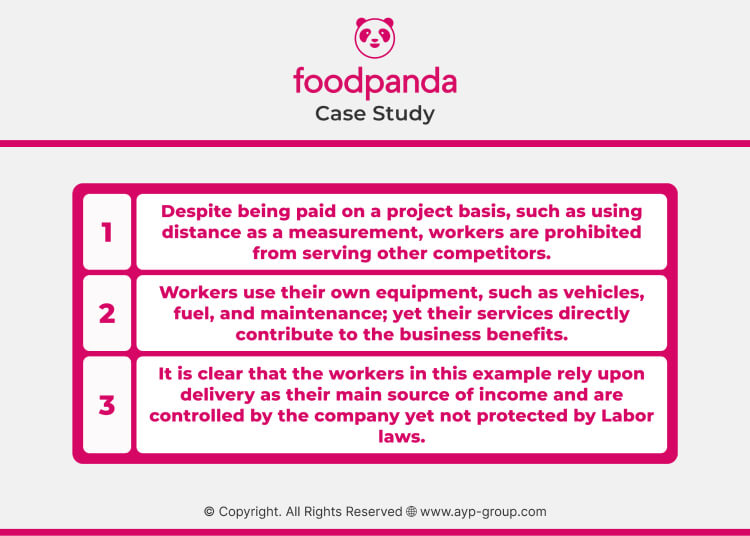

The Hong Kong Foodpanda protest situation is a good example to illustrate the blurred lines between a contractor vs. an employee.

Foodpanda pays a delivery worker according to the number of deliveries made. The company does not provide social security contributions nor file income tax on behalf of the contractors. However, disputes arise when the company asks the workers to wear uniforms and restricts their employment opportunities to work with competitors.

The workers are also struggling to earn the expected income according to the contract due to long waiting times and unclear delivery measurements set by the company. Further, there has yet to be an agreed project timeline to accomplish which the employment relationship can last for an extended period 3.

A contractor is typically guarded with a contractual or service agreement. From Food Panda's case study, we can see that:

The Labor department of Hong Kong 4 clearly stated that without the employee's approval, an employer should not unilaterally convert the employee's status to a contractor. Otherwise, employees may lodge a claim against the employer for violating the terms stated in the contract.

When you want exclusivity

Contractors with exceptional talent and expertise exhibit invaluable qualities; converting them to employees brings mutual benefits for their long-term career growth and prevents them from working for your competitors.

In fact, according to research from the Journal of Organizational Behavior 5, employees who perceived that they were well-treated were more affectionate and committed to their company and exceeded the required work responsibilities.

Employees' perceived employer's obligations might increase in response to the employee's benefits given. In contrast, employees' proactive response decreases when organizations fail to perform their employer's obligations.

Moreover, employees frequently associate stronger emotional attachments with the company, especially relating to organizational mission, goals, and principles, compared to a more transactional relationship as a contractor.

Navigating Economic Uncertainty: HR Strategies for Business Resilience Tap in to explores the pivotal role of Human Resources (HR) in shaping business resilience during economic uncertainty

Contracting vs full-time for employers

Converting your contractors to employees might be a difficult decision now, and it involves much-deliberated discussion among your management team. Here is our final checklist for your consideration:

- Nature of work: Do you need direct control and supervision to monitor closely how the tasks are completed, or do you require certain specialized skills to work on project-based work?

- Cost and Flexibility: Do you require a long-term commitment from your workers, and do your contractor have their own company and are responsible for their tax reporting and declarations?

- Legal and Compliance: If you are hiring contractors, especially from a foreign country, are you complying and adhering to the contractor’s local statutory requirements?

- Skill set and expertise: Are you hiring industry experts with specialized knowledge? It is better to hire them on a project basis to save long-term costs but seek legal advice on your contractor service agreement.

- Relationship and company culture: If aligning company goals and integration into your organizational culture is an integral part of the job, hiring employees will be the sustainable way to do so.

Are you evaluating the cost of hiring project-based workers or full-time employees?

Talk to us directly for FREE advice on cross-border employment contracts, hiring, and payroll solutions!

Follow our LinkedIn page for more useful advice.

References

- Nike could be fined over $530m for misclassifying thousands of workers

- Fact Sheet 13: Employment Relationship Under the Fair Labor Standards Act (FLSA)

- Foodpanda deliverymen launch strike over unfairly wage cut

- Clarify Your Employment Status

- Perceived organizational support and psychological contracts: a theoretical integration