1. What is Disguised Employment and Avoid the Risk

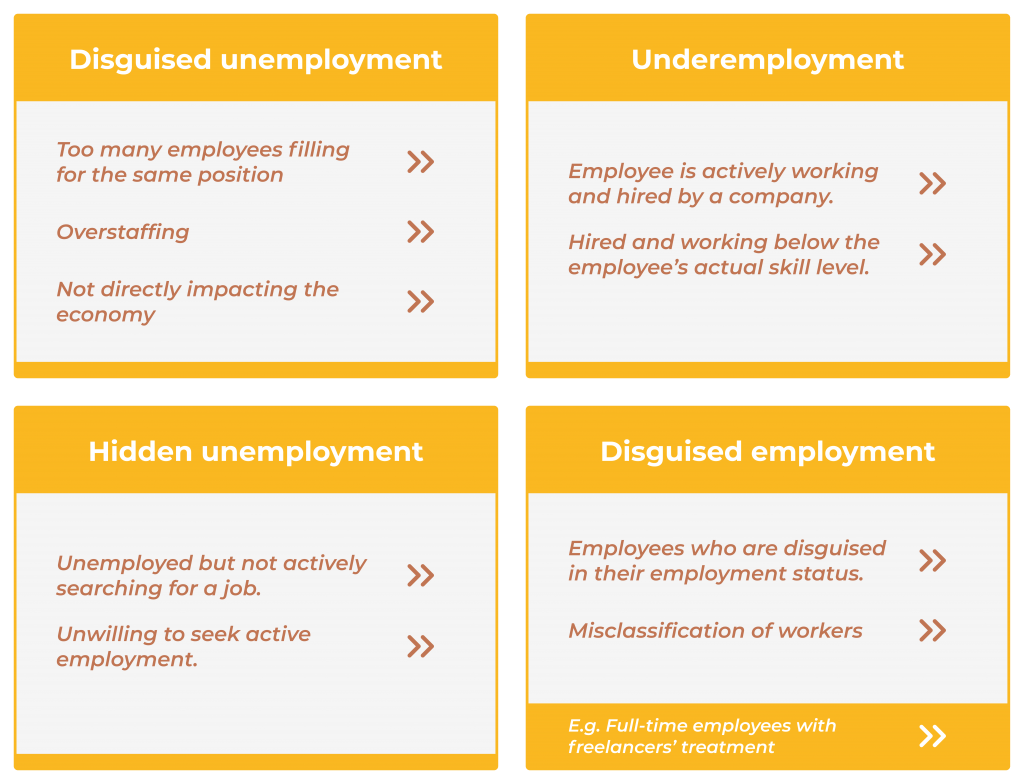

Disguised employment is often confused with disguised unemployment. However, both are distinct in referring to a different context. So before we dive in to explain disguised employment, let's have an overview of the terms that are frequently linked and overlap with disguised employment

1.1 Disguised unemployment

Disguised unemployment refers to worker productivity that is near zero. It happens when too many employees fill the same position and do the same work redundantly.

In economic terms, disguised unemployment refers to any part of the population segment that is not employed at total capacity. This situation leads to low productivity, where the overstaffing issue happens when many staff are filling the same role, leading to job inefficiency and distribution.

In such a situation, disguised unemployment does not directly impact the total economic activity in aggregate; therefore, it is classified as "disguised".

1.2 Underemployment

Underemployment is often strongly associated with disguised employment because the employee is technically actively working and hired by a company.

For instance, a person with a law degree accepting a full-time clerk position in a legal firm handling mainly administrative duties is classified as underemployed. Apparently, this person is actively receiving an active income but is working below their skill set levels.

Similarly, part-time workers may be classified as underemployed if they intend to become full-time workers; are capable and willing to perform full-time instead of part-time work.

1.3 Hidden unemployment

Disguised employment is also not related to hidden unemployment. Hidden employment refers to individuals who are unemployed but are not actively searching for a job or preparing to re-enter the workforce.

According to the definition of unemployment, this group of people are excluded from the unemployment statistic as they are either unwilling to seek active employment or have given up searching for a job.

2. What is disguised employment?

Pretty much interrelated with underemployment, a disguised employee is disguised in their employment status. Misclassification of workers, where hiring employees as independent contractors, is a typical example of disguised employment.

The freelance or part-time worker is an employee of the company, which either the company unconsciously or consciously misclassifies workers in such a way as to exploit their employees' rights. In this way, the company hires freelancers but treats them as full-time employees to complete their work.

3. What is the reason behind disguised employment?

There are mainly two (2) reasons for disguised employment.

First, global companies have experienced financial stagnation or even loss of profit.

Hiring project-based employees cope effectively with fluctuating workloads and business uncertainties; temporary employees help to streamline business operations, giving more employment flexibility.

Secondly, global hiring trends and employees' demand preferences have changed. For example, India has created up to 90 million gig opportunities for part-time workers.

The easy entry and exit nature of the "gig economy" attract people to work full-time as contractors or service providers.

Hence, increasing the chance of classifying workers as independent contractors if employers are not cautious.

4. Is disguised employment illegal?

The answer is yes. According to the Fair labor standards act (FLSA) from the United States Department of labor 1, employers must pay employees the minimum wage for every hour worked.

Employers should also pay overtime payments to employees working over 40 hours per week, and maintaining records is mandatory.

On the contrary, employers who hire independent contractors are not obliged to comply with the rules stated above nor required to keep any records for contractors as they are not employees protected under the act.

Since labor laws protect employees, misclassifying employees as contractors could put employers at legal risk or penalties, regardless of whether the company is aware that they are hiring a disguised employee.

The consequences of a disguised employment relationship are severe as it deprives all types of worker's compensation, paid leaves, overtime allowances, minimum wage and social security coverage.

The freedom of negotiating workloads, wages and hours, and dismissal compensation, are all seized for a disguised employee.

Moreover, workers are not entitled to claim unemployment insurance as they are not employed as full-time workers legally. For example, learn the 6 facts about the employment insurance system in Malaysia and why it is compulsory in Malaysia.

5. Remote hiring and disguised employment

According to Buffer's 2022 State of Remote Work report, a whopping 97% of employees would like to work remotely for at least some time for the rest of their careers 2.

With the increasing popularity and preference for remote jobs, companies hiring remote workers possess greater risk in disguised employment.

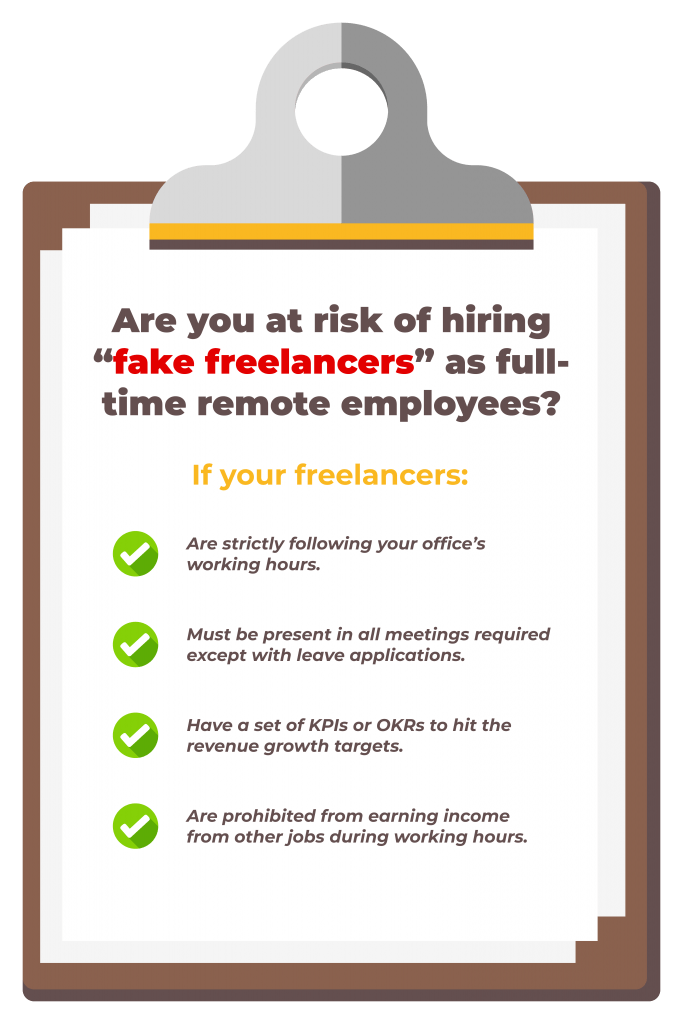

If an employee is working full-time for a remote company:

- The employee should strictly follow the work schedule and hours determined by the employer.

- The employees work according to the company's KPIs or OKRs to meet the company's requirements and timeline to hit the revenue growth targets.

- Employees must be present during daily meetings or any meetings required by the company except with leave applications.

- As full-time workers, employees cannot earn additional income from other jobs, prohibiting their opportunity to work with another company.

Remote companies are often hiring anywhere and expanding fast in locations even without an entity.

Due to the fast market entry demand, companies may deliberately or unintentionally employ full-time employees but treat them as "full-time freelancers".

In this scenario, the employee becomes a false self-employed person known as a "fake freelancer" because their source of income depends on a single-payer or employer, and the opportunities to work with other agencies or clients are prohibited.

The "forced entrepreneurship" employment relationship has been established between the remote hiring company and the disguised employee.

Companies save costs when they take on employees under the guise of a contractor's contract, where employee provisions, taxes, insurance, and contributions are not required. Hence, unconsciously violating the laws.

6. Avoid disguised employment with AYP's solution

Avoid falling for this trap when hiring abroad, or your company will get in trouble regarding corporate compliance.

We understand your business concerns and intention to hire remote workers all over the APAC region, to understand everything related to international employment laws and compliance regulations from different countries.

But as seen above, hiring remote workers from a foreign country might potentially put you at risk in disguised employment if you do not provide them with the country benefits they deserve.

Get through this hurdle: Expand confidently and compliantly

By leveraging AYP's HR knowledge and expertise, your company can achieve corporate compliance without knowing all the laws and regulations.

In fact, by trusting AYP's PEO / EOR solutions today, you can hit the ground running in a new location without much trouble and worry.

About AYP:

- Best PEO Service Provider (Silver)

- Best EOR Service Provider (Bronze) from HRM Asia's Readers Choice Awards

Pay your global employees with a simple, swift, and smart solution:

- We cover payroll in more than 130 currencies

- Digital onboarding anytime, anywhere

- Ensuring all compliance issues and legal advice backed up with 100+ payroll and legal experts

Get a FREE customized plan and learn more about how this platform can assist your company in business growth today!

Do you find the information valuable? Please follow us on LinkedIn or Facebook page for more upcoming blogs.

Featured Content

1. Why HR Automation is Critical for Business Success

2. Easily Automate Your Onboarding Process with AYP

3. 3 Countries in Asia with the Greatest Hiring Potential for Manufacturing