Discover how having an Employer of Record (EOR) in Thailand helps businesses hire employees quickly & efficiently so you can expand your business smoothly without interruption

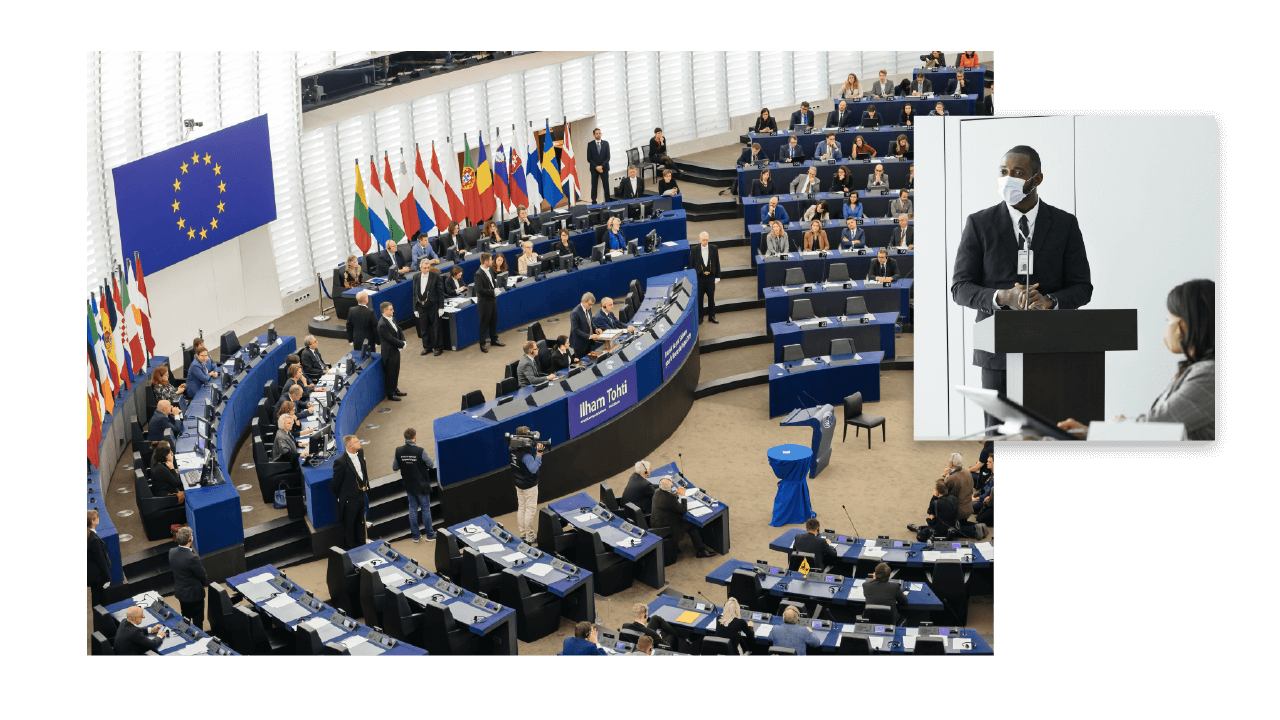

This is a common struggle for many high growth companies due to the language barriers, cultural differences and the complex, ever-changing employment laws. Look no further than our employer of record solution.

Sit back while focus on your core business while we take care of the rest.

Got a great business idea and looking to hire employees in Thailand? AYP Group (AYP) has got your back! Our Thailand EOR helps you hire employees quickly and efficiently, so you can focus on your business goals.

Forget about the lengthy and expensive process of setting up a legal entity – we’ll take care of all the HR, benefits, payroll, and tax needs for the employees.

Compliance with local employment laws

Reduced hiring time and cost

Minimized legal and financial risks

Dedicated HR support and expertise

Seamless onboarding and payroll management

Access to a wider talent pool

Our process is simple and efficient. First, we hire the employee on your behalf and become their official employer.

Then, we manage all legal and administrative tasks, including payroll, taxes, benefits, and compliance.

Finally, we work closely with you to ensure a smooth and successful onboarding process.

Our solution offers complete transparency in pricing, so you know exactly what you’re paying for and can manage your workforce costs more effectively.

Our all-in-one compliance management system simplifies HR processes across jurisdictions, freeing up your time to focus on growing your business.

With our platform, you have access to local compliance experts who can guide you through the complexities of managing a distributed workforce, ensuring that you stay compliant with local laws and regulations.

Don’t let the complexities of employment laws in Thailand slow down your business growth. Choose our employer of record solution and simplify your hiring process.

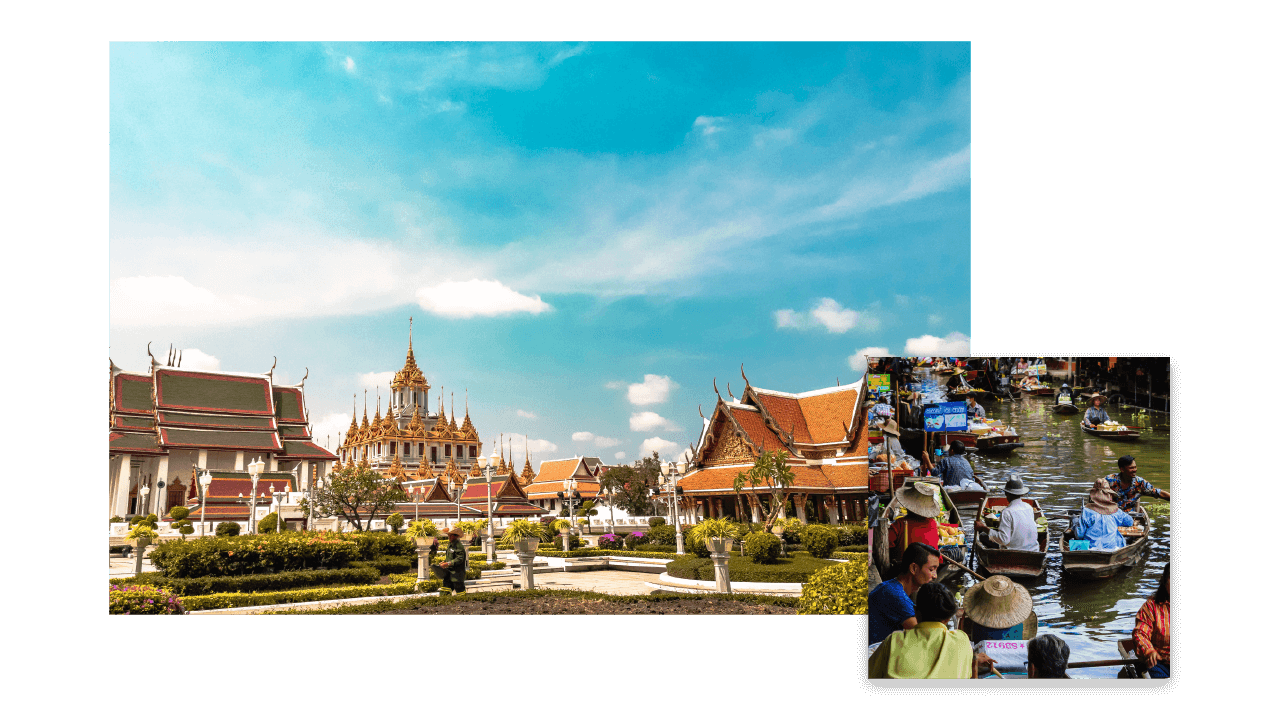

Thailand is a country located in Southeast Asia. It is the 50th largest country in the world, and is known for its beautiful beaches, ancient temples, and delicious cuisine. The country has a population of about 69 million people.

The economy of Thailand is driven by exports, particularly of textiles, clothing, and electronics. Tourism is also a major contributor to the economy, with millions of visitors each year drawn to the country’s tropical climate and cultural attractions.

Bangkok

THB (Thai Bhat)

Thai

Constitutional monarchy

There are two types of employment contracts in Thailand:

1. Fixed-term

A fixed-term contract is for a specific period of time

2. Indefinite contract

Has no specified end date.

The employment contract should include details such as the employee’s job title, duties and responsibilities, working hours, salary and benefits, and any probationary period. It should also outline any termination procedures and any provisions for severance pay.

In Thailand, it is important for both the employer and the employee to understand their rights and responsibilities under the employment contract. Employers should ensure that the employment contract complies with Thailand’s labor laws, and employees should carefully review the contract before signing it to ensure that they understand and agree to its terms.

The standard work week is 48 hours, with a maximum of 8 hours per day and 6 days per week

Here is a list of national holidays in the Phillippines:

In Thailand, employers are required to make contributions to various social security benefits programs on behalf of their employees. These programs are administered by the Social Security Office (SSO), which is a government agency under the Ministry of Labor.

Provides coverage for employees in case of accidents, illness, disability, or death.

Employers are required to contribute a certain percentage of their employees’ salaries to the SSF, and employees are also required to make contributions. The SSF also provides benefits such as maternity leave and paternity leave.

A retirement savings plan for employees. Employers are required to contribute a certain percentage of their employees’ salaries to the EPF, and employees can also make voluntary contributions.

The EPF provides a range of benefits, including a pension, a lump sum payment at retirement, and financial assistance in case of disability or death.

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |