Achieve 98% Employee Satisfaction Score with AYP

Empower your Asia workforce with seamless onboarding, compliant payroll, and exceptional support—because happy employees drive success.

No Uncertainties: Comprehensive advisory with local HR support and guidance at every step.

No Penalties: Guaranteed compliance with all regulations.

No Hidden Costs: Complete pricing transparency for peace of mind.

Trusted by global leaders across industries

We help you hire remote employees across Asia, compliantly and easily.

Hire your talent anywhere in Asia

Build your dream team with our Employer of Record (EOR) solution. We help you effortlessly hire employees across Asia while complying with local employment laws – so you can grow seamlessly across the globe.

Discover Employer of Record

.avif)

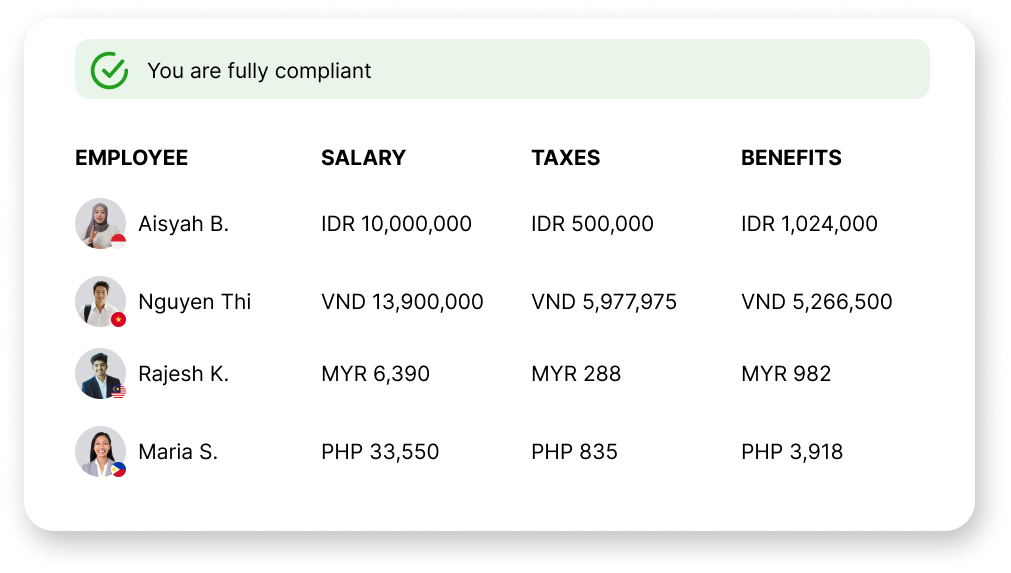

Pay Your Team with Confidence

We ensure that your team across Asia is compliant with local employment laws in every country. We handle all payroll, taxes, and benefits so you don’t have to worry about it.

Discover seamless payrollOur difference

Here’s how we’re different from the rest. We’ve got the localised HR advisory and compliance expertise you need, all with unmatched price transparency.

In-house Expert Advisory

HR specialists provide country-specific guidance on employment regulations, statutory benefits, and tax laws across Asia, ensuring compliance with every step.

Compliance Across the Employee Lifecycle

Localized contracts, pay, benefits, and policies aligned with country-specific regulations across Asia.

Transparent Prices

No hidden fees. No surprises. Our flat monthly rate guarantees peace of mind.

Our customers love us

AYP has been a reliable partner, ensuring overtime calculations are always accurate and payments are consistently on time. The transition process has been smooth and hassle-free, making everything easy for us. We truly appreciate the professionalism and efficiency of their services

.png)

Working with AYP over the years has been a fantastic experience. Their team consistently provides responsive and reliable support, making our operations smoother and more efficient. Their dedication to our needs has made them an invaluable partner, and we couldn’t be happier with their service

.png)

Switching over to AYP to be our regional payroll vendor has allowed us to benefit from their strong local statutory knowledge of countries such as Singapore, Malaysia, Thailand, Philippines and Vietnam. It also helps that they have dedicated local resources in each of these countries to manage the payroll services respectively. I will definitely recommend any companies who are expanding within the SEA region to strongly consider working with AYP as their payroll partner.

Get started with AYP in three simple steps

Book a call

Book a call with our hiring experts. We’ll understand your needs and show how we can help your team grow in Asia. You’ll get a cost simulation proposal.

Add your employees

Sign up and use our self-serve platform to onboard new hires. Get compliant local contracts and insurance coverage for your team.

Dedicated support

Our HR experts will help you with local laws and team support. We make sure your setup is smooth and easy.