Before we present to you the 5 vital aspects of an ideal payroll software system.

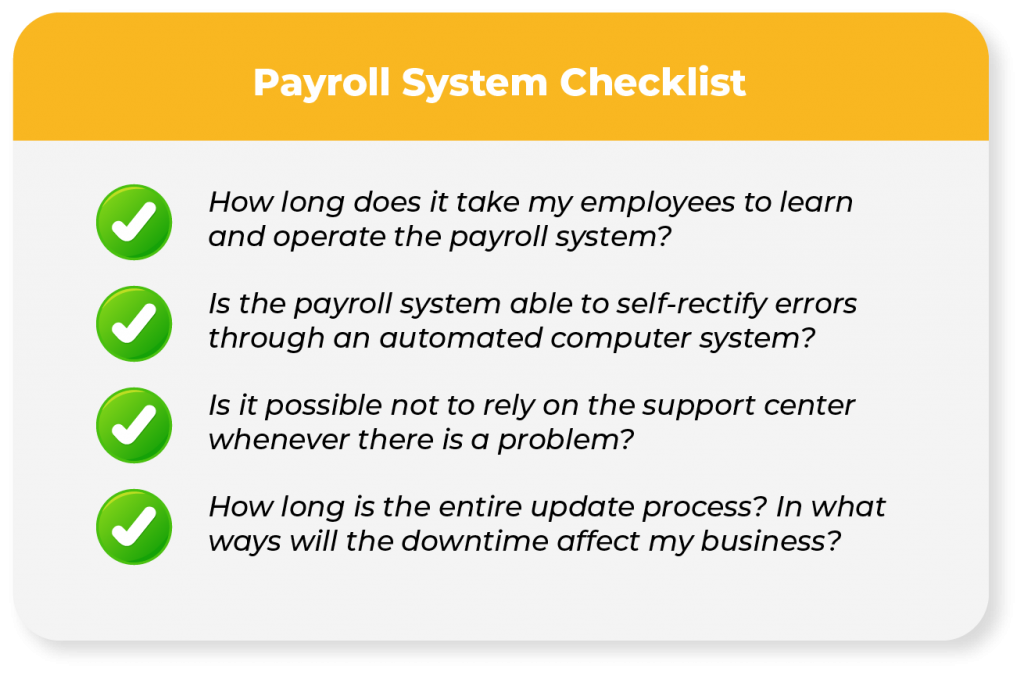

Here is a checklist to evaluate whether should your company relook into your current payroll system:

1.Spending on multiple software to meet the legal requirements for employees in different countries.

2.Have experience paying for payroll tax penalties due to unfamiliarity with cross-country rules and regulations.

3.Lack of data visibility to make real-time business decisions.

4.Expensive forex and bank charges to pay salary across multiple locations.

If you are somehow experiencing the above challenges as your current pain points, you have come to the correct place.

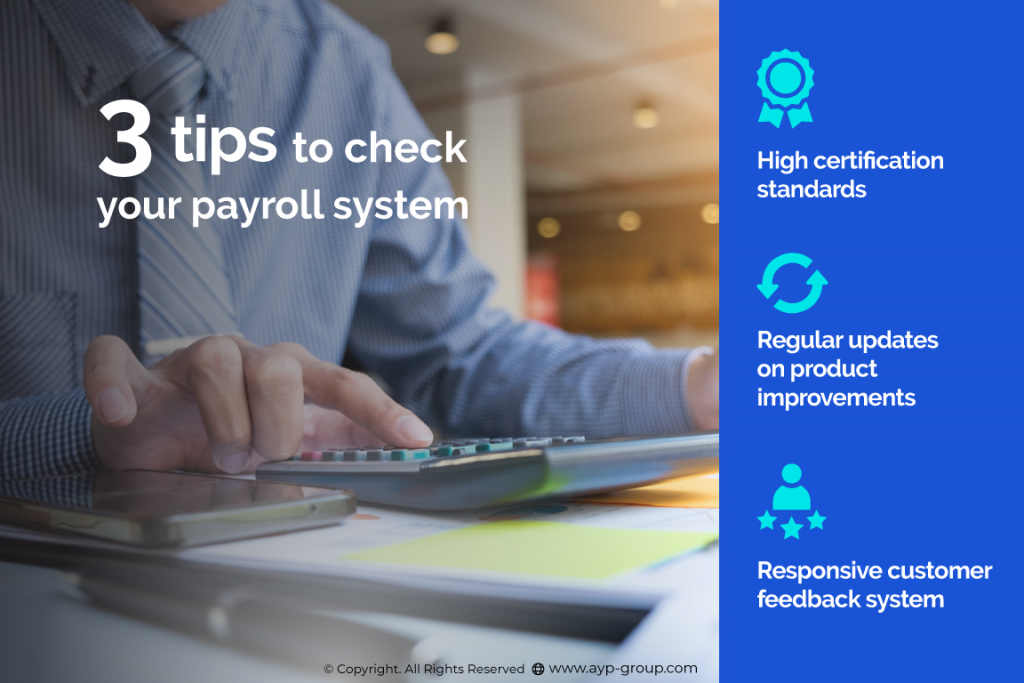

How to select the best payroll system for your company, and what aspect should you consider?

Let's learn about the 5 aspects that your payroll system should have.

1. A User-Friendly Payroll System Makes HR Work Easier

A Payroll manages various administrative tasks, it is essential to find one to make your HR department and users' lives easier. That means picking software systems that are easy to use and accessible across multiple devices.

For increased convenience, look out for a payroll system that allows you to troubleshoot any slight issues by yourself. The software should be well-designed with built-in procedures according to the user experience.

Well-designed software will even allow non-technical staff to configure the software in a few steps without seeking consultation.

The ideal payroll software system should be simple to access and navigate with a clear and simple customer journey. You should also be able to customize the system to suit your particular business needs.

2. Top-Notch Security Prevents Expensive Security Breaches

Aside from user-friendliness, security protocols in a payroll system are vital to protect all sensitive data. Everyone with access to the software should only be able to get the data that they need and use.

Data including personal information and sensitive information should be adjusted to the user's roles and responsibilities. This helps to protect your company and your employee's personal data from accidental or purposeful cyberattacks.

If you overlook the importance of security, it may cost you a very expensive payment. According to IBM, the cost of an average data security breach in 2021 is USD 4.24 million, it further increased to 4.35 1million last year. The cost has reached its highest over the past 18 years. Learn why SMEs experienced 350% more social engineering attacks compared to larger companies.

3. Automation of Administrative Tasks Saves Your Company’s Time and Money

Automation enables your company to onboard, manage and pay employees automatically. An automated payroll system can reduce approximately 70 to 80% of repetitive tasks. 2.

In a way, HR staff would reduce unnecessary paperwork and costly mistakes in administration, allowing them to create more value-added responsibilities. Furthermore, the payback period takes approximately only 9 to 12 months from a good custom payroll software, such as an RPA (robotic process automation).

The entire payment procedure moves more quickly when the computations and deductions are accurate according to the user's account. This guarantees employee benefits by providing the correct payslips without error.

In Singapore, a PEO / EOR service provider can help you to manage your employer and employees’ CPF contributions and income tax. This will greatly reduce your HR manager's effort and hassle to do it manually.

PEO / EOR can provide an automation solution for your payroll, especially when the payroll system is needed to cover multiple entities. They are able to offer accurate business advice and reduce the need to engage another third party at additional cost.

4. Statutory Compliance

The payroll software provider should help you to adhere to the local legal requirements according to the country's laws.

The ideal payroll system would provide reports and statements that your HR personnel can submit to the income tax department, provident fund, employee state insurance, and local authorities.

The payroll software should include the provision to configure the income tax laws of different countries. The software should automatically calculate the amount of income tax due and create tax return statements to submit to the income tax department.

Good payroll software can generate salary transfer statements to be submitted to the payment banks directly. If the software can perform this, it will save your finance department time to do this tedious work.

Like the general workforce, the key roles of the Human Resources department are evolving to become more strategic and less administrative. Empowering your HR professionals to efficiently and effectively deliver greater value to the workforce is essential.

Subscribe For Exclusive Updates!

Become an insider in the fast-paced world of HR. AYP Monthly Digest delivers the latest trends, insights, and expert advice directly to your inbox, making you a VIP in the know

5. Cloud Payroll System To Manage Multiple Currencies

When you have multiple entities in different countries, HR roles can be challenging to juggle between currency calculation and complying with different rules and regulations.

The payroll software should enable currency conversion according to the paid-out time and produce reports for each currency. Your company should be allowed to process all different currencies from your HQ using the software.

Payroll over a cloud system eliminates the need to worry about server maintenance and other IT-related concerns. It is more cost-effective to save your company a lot of money as you are not required to hire IT engineers or buy expensive software.

What if I tell you that there is an even more cost-effective method? That is to engage an EOR service provider who is not only an out-of-country payroll expert but also expertise in paying multi-countries staff at the same time.

An EOR provides a payment solution for you even if you have many employees from different countries. EOR pays your staff according to their local currencies compliantly and on time.

Get your personalized plan and learn what an EOR can provide.

Be sure to also look out for payroll systems that have embedded business intelligence. It will help you to generate reports automatically and keep up with any updates on compliance issues across different countries.

Introducing a software equipped with the 5 vital aspects above

All of the issues above can be resolved by using HR software like AYP Global Pay, allowing you to manage both your staff and your business with ease and without worries.

- Simple, swift, and smart is the brand promise of AYP. Under a single platform, everything from onboarding to claims and payroll can be conveniently viewed and monitored.

- While you may be concerned about the high investment cost to invest in data security to protect your employee’s payroll, AYP global pay is a perfect choice to mitigate this risk with a lower cost to spend on high technological solutions.

- One of the key selling points of AYP is offering an HR automation solution. Everyone in your company can create, receive, share documents, and gain access from a single centralized location.

- If statutory compliance is your major concern, AYP offers both PEO & EOR services with more than 100 legal experts who are very familiar with different APAC countries’ labor laws and regulations.

- AYP offers EOR services, it is the safest approach to employ remote employees according to their country's labor law and pay the salary according to their country's currency.

To date, AYP has assisted half a million users to get access to all HR features conveniently. This includes automated compliance, digital onboarding, and payroll in more than 130 currencies.

We are more than an HR technology solution provider; we constantly collect customer feedback even after the sales are closed. Read about what our clients say about us.

The best payroll system should match your company's requirements according to your business conditions while also empowering your management controls as a business owner.

Featured Content

1. The Future of Payroll Management

2. The Next Big Trends in Payroll Management

3. Top 5 Reasons To Use AYP Global Pay